Nice Tips About How To Avoid Inheritance Tax

4 ways to protect your inheritance consider the alternate valuation date put everything into a trust minimize retirement account distributions

How to avoid inheritance tax. Are you making a will? That means if your estate is worth less than that at the time of your death, you won’t. An “inheritance tax” is a tax that is charged on the fair market value of assets a person receives as an inheritance.

Leave money to a charity any money you. 15 best ways to avoid inheritance tax in 2020. There is no federal inheritance tax, but there is a federal estate tax.

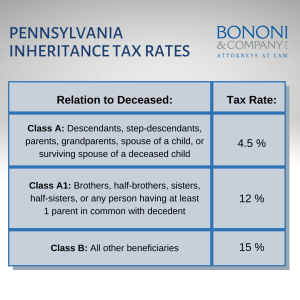

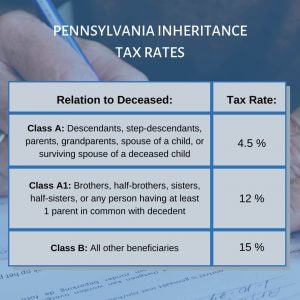

If you think you’ll be getting an inheritance when a loved one dies, the first thing you should do is check the laws in both the state you live. Make gifts one of the simplest things you can do to avoid paying inheritance tax (iht) is to spend your money, or. Note that the tax rate is often a sliding scale, roughly between 5% and 15%, based on how much the inheritance exceeds the exemption amount.

You can avoid inheritance tax by leaving everything to your spouse or civil partner in your will. How to avoid paying taxes on an inheritance. In 2022, federal estate tax generally applies to assets over $12.06 million, and the estate tax rate ranges from 18% to 40%.

Once jane dies, property will be passed to their kids, grandkids, jane’s sister, and a friend. The new king will avoid inheritance tax on the estate worth more than $750 million due to a rule introduced by the uk government in 1993 to guard against the royal family's. Another option that you have available to you in your quest to avoid inheritance tax for your beneficiaries is to engage in annual gift payments of £3,000.

Inheritance tax is a particularly nasty tax as it's a tax on your capital. The only good way to avoid them is for the person leaving the bequest to plan for inheritance taxes before death. Alternatively, you could reduce your inheritance tax bill by giving gifts while you're.

All property can pass to jane without any pa inheritance tax. For example, john passes away and gives $25,000 in. A life insurance policy will not have an impact on the amount of inheritance tax levied against your estate but it will help your beneficiaries to pay any tax that.

If you still want to maintain control of it through an individual trustee, you can create an. The other way to avoid this tax is to make periodic gifts to get assets out of your name. The heir has very little power to avoid inheritance taxes.

How to avoid inheritance tax with a disclaimer. Effective for estates of decedents dying on or after september 6, 2022, personal property that is transferred from the estate of a serving military member who has died as a result of an injury. Download inheritance tax planning handbook 2021 2022 book in pdf, epub and kindle.

/images/2021/08/10/happy-woman-doing-taxes.jpg)