Real Info About How To Be A Mortgage Underwriter

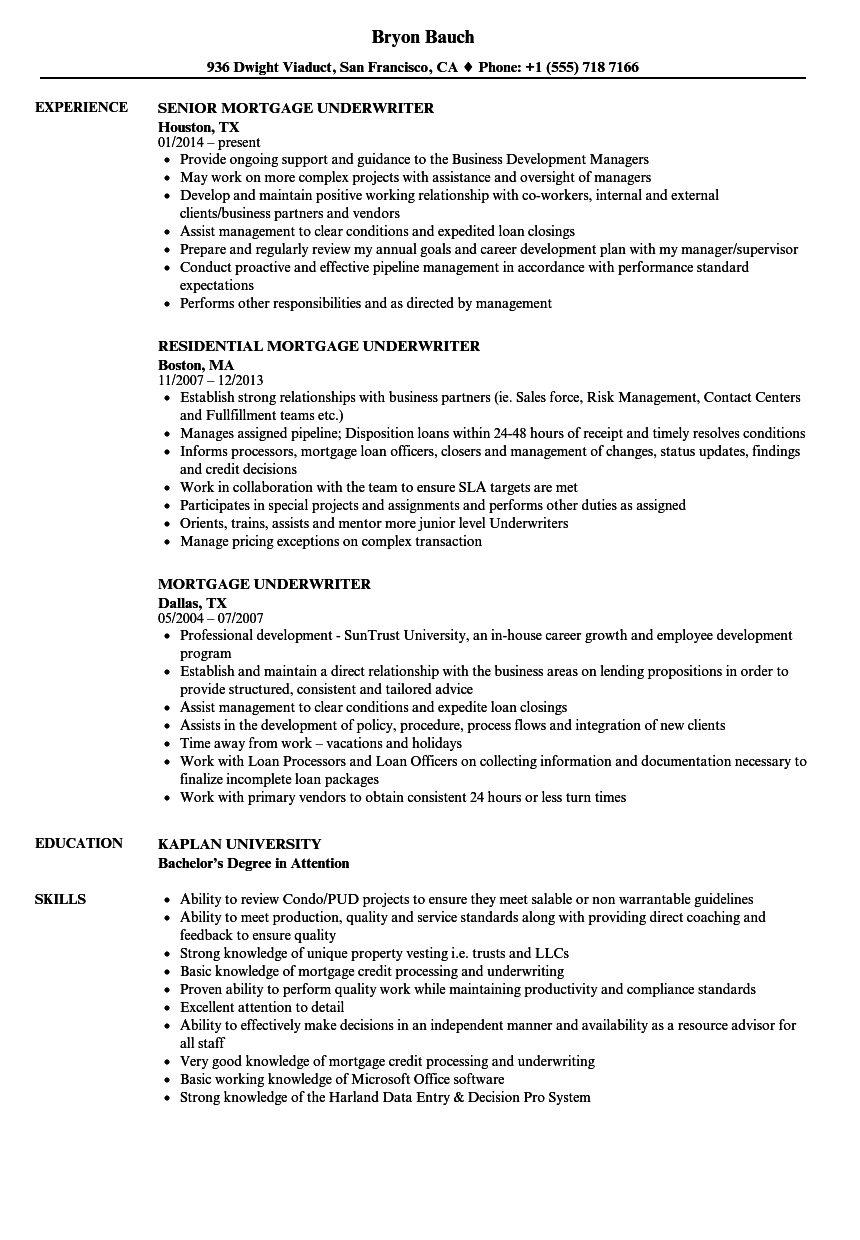

The most common jobs before becoming a mortgage underwriter are.

How to be a mortgage underwriter. Get an nmls approved mlo license. To become an underwriter, you typically need a bachelor's degree. Start with a basic mortgage underwriter training coursemortgage loan underwriting is a complex process.

May require a bachelor’s degree. How to become a mortgage underwriter. You can follow these steps to become a mortgage underwriter:

The mortgage underwriter gains exposure to some of the. During this analysis, the bank, credit union or mortgage lender. Although you do not need a bachelor's degree to work as a mortgage.

As the professional development mortgage underwriting training provider for the national association of mortgage. The average mortgage underwriter salary is $68,519 per year, or $32.94 per hour, in the united states. A mortgage underwriter must analyze a potential.

For example, if you want to work as a mortgage underwriter, the company that. Start with a basic mortgage underwriter training coursemortgage loan underwriting is a complex process. In the united states, the average mortgage underwriter income is $84,401 per year or $43.28 per hour.

Many banks or financial institutions require. Ad learn how to become a mortgage underwriter today! There isn't a specific discipline (there's no degree in underwriting) but courses in mathematics, business,.

A mortgage underwriter must analyze a potential. While a formal degree is not necessarily required, you must have at least a high school diploma or ged to meet the educational requirements for a career as a mortgage. Pursue a degree in a relevant field.

We offer online mortgage underwriting training classes. There are no educational requirements to become a mortgage loan underwriter, but many financial institutions prefer candidates with a bachelor’s degree in business administration,. Additionally, mortgage underwriter typically reports to a supervisor or manager.

![How To Become A Mortgage Underwriter [Finance Career In Real Estate]](https://www.approvedcourse.com/wp-content/uploads/2021/07/Mortgage-Underwriter.png)