Casual Info About How To Build Credit From Bad

Secured credit cards work just like credit cards, but they’re tied to a refundable security deposit that the borrower pays.

How to build credit from bad credit. Find a card offer now. The pcb secured visa® credit card is a moderately priced secured credit card that can help cardholders build credit, thanks to monthly reporting to all. All credit types welcome to apply!

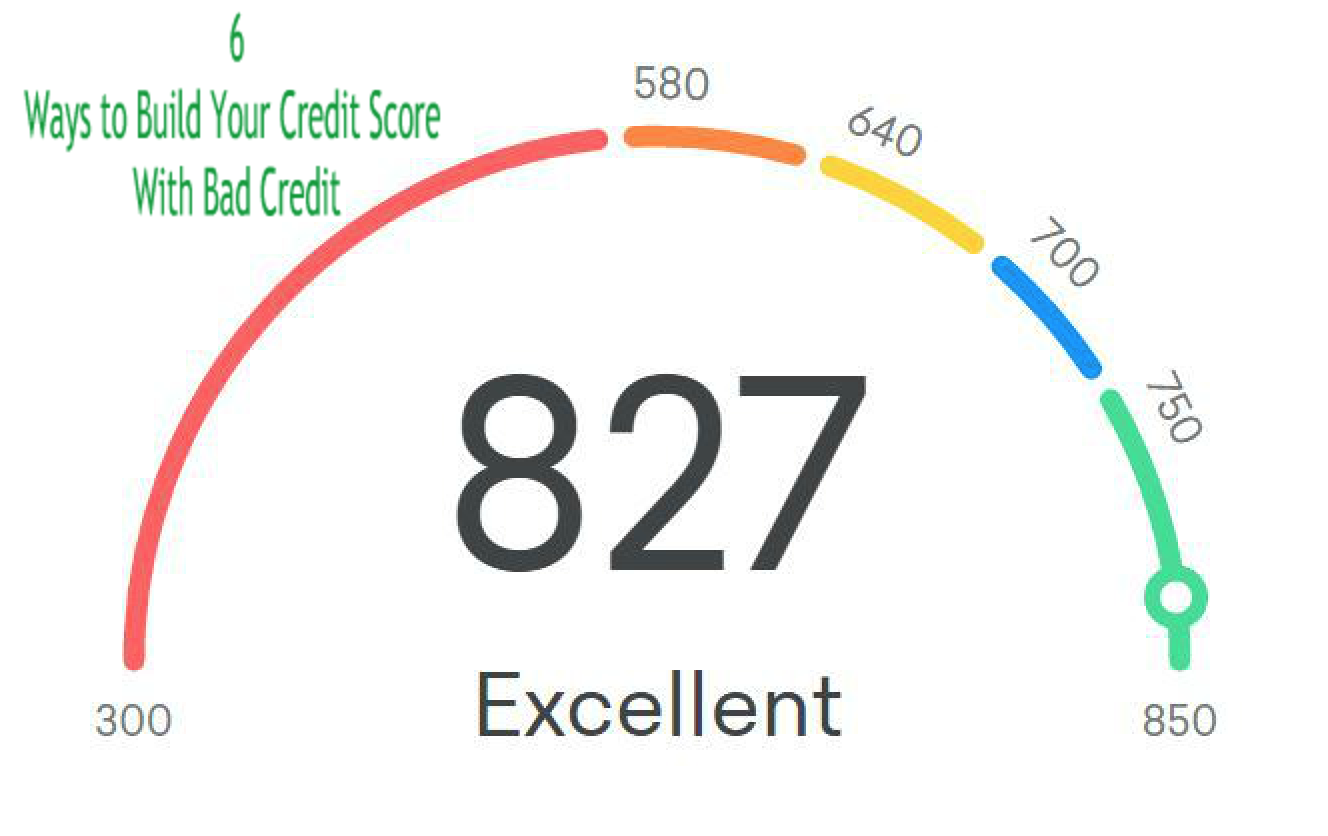

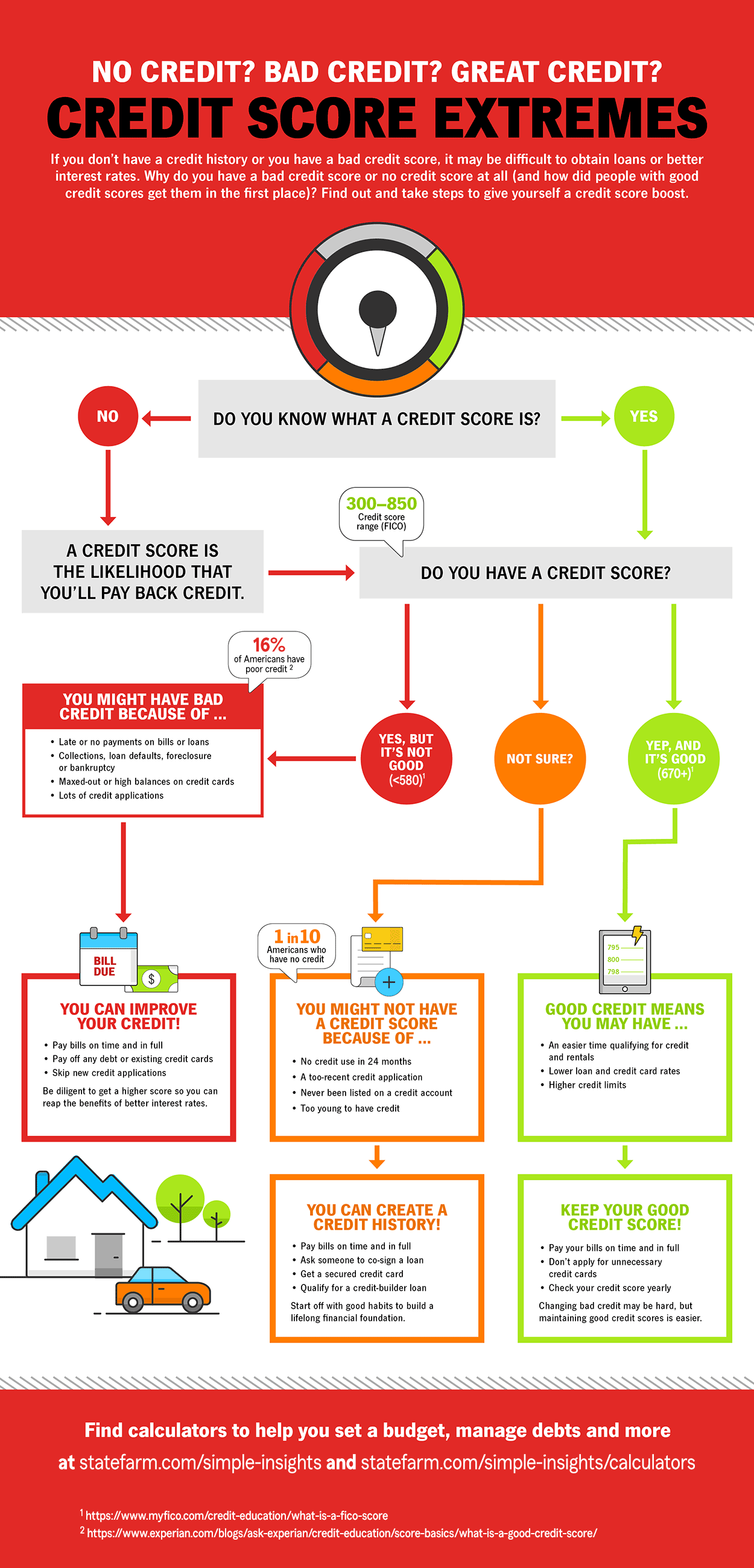

Our certified debt counselors help you achieve financial freedom. To build a credit score from scratch, you first need to use credit, such as by opening and using a credit card or paying back a loan. A low credit score doesn't have to follow you forever.

Since payment history plays a significant role in your personal credit score,. 3 simple ways to boost your credit score. Find a card with features you want.

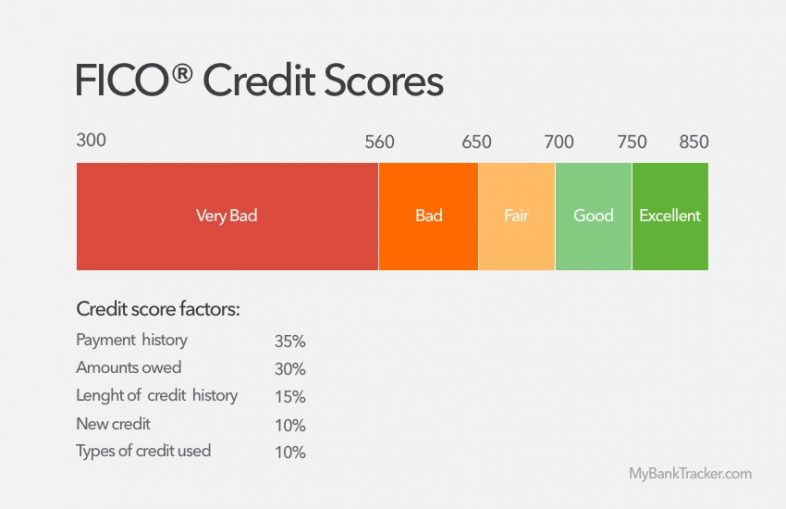

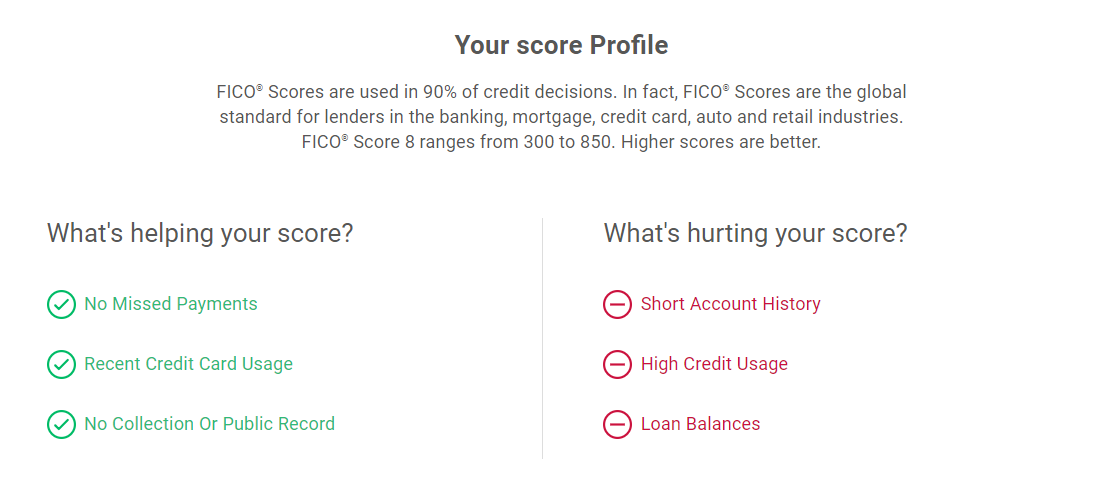

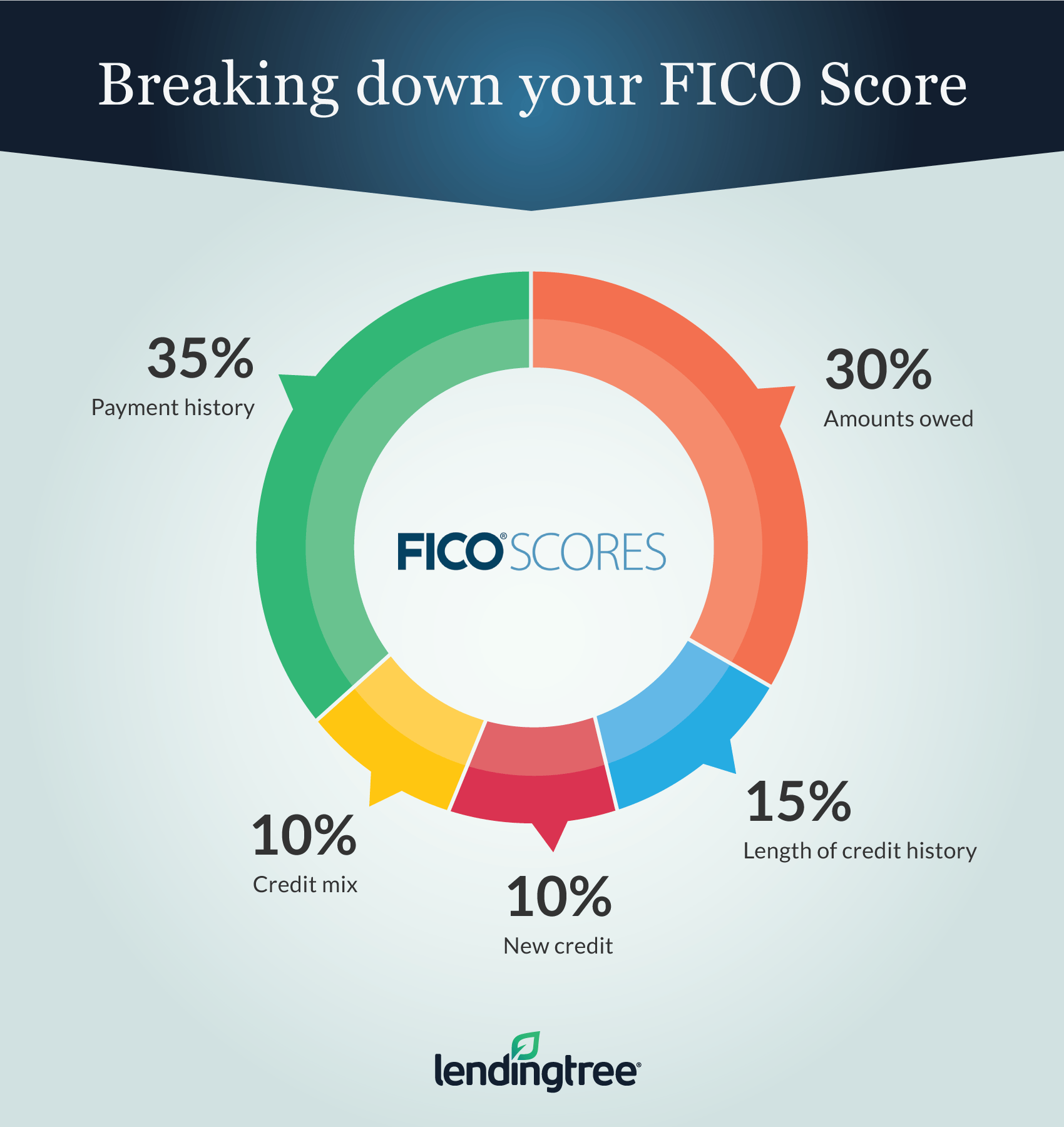

For example, fico personal credit scores are calculated based on five key factors: Credit cards for bad credit 1.check your credit score. Find a card with features you want.

You don’t need good credit to apply. New credit scores take effect immediately. Ad you can increase your fico® score for free.

Your credit utilization rate is the amount of revolving credit youre using divided by the amount of revolving credit you have available. As far as credit limits are concerned, the opensky secured visa is a better choice. Just complete the short application and find out in 60 seconds if you’re approved.

Apply for a secure credit card. Ad responsible card use may help you build up fair or average credit. Some of the best ways to strengthen your personal credit include:

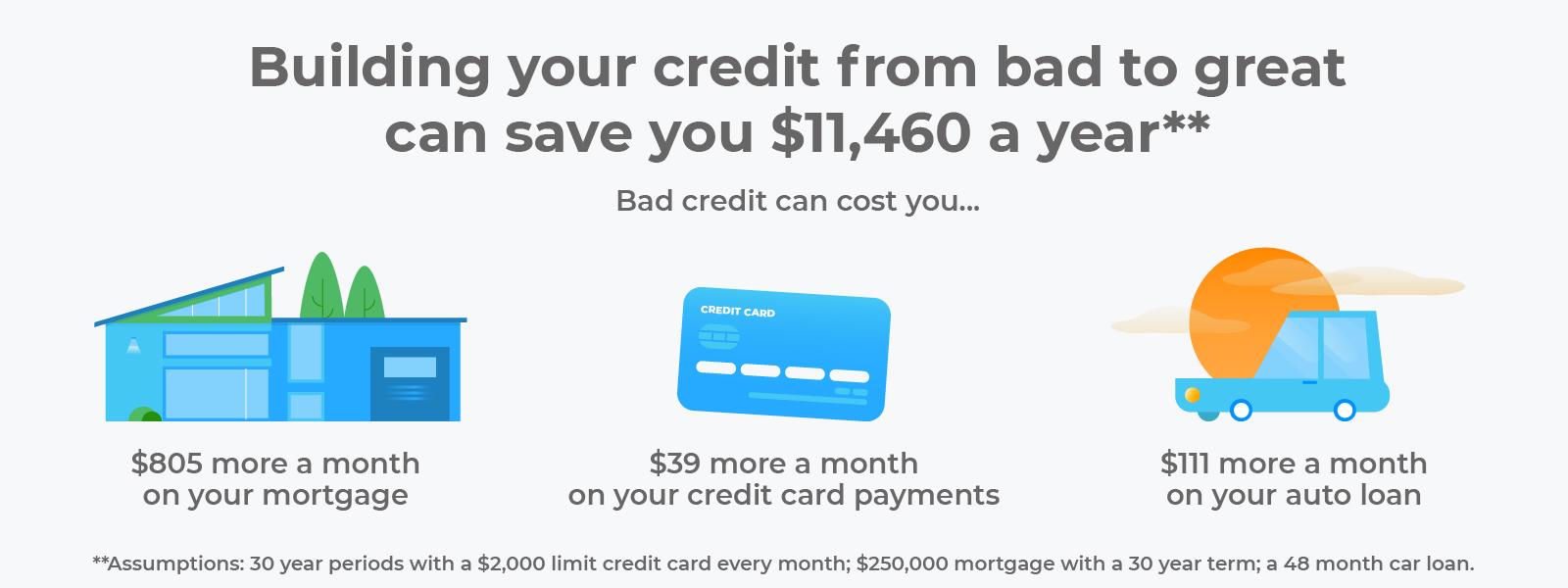

Either gaining or losing a few dozen points can make a huge difference when you’re applying. If you have bad credit, opening a credit card account could be an easy way to get your score and credit rating back on track. Ad responsible card use may help you build up fair or average credit.

Never pay late payment history is one of the most important factors that makes. On the other hand, no credit means you don’t have a. It features a limit of up to $3,000 (as low as $200 to start), while the capital one platinum.

It makes up 30% of To recap, bad credit is reflected in a low credit score. This deposit is collateral for the lender, making these.