Casual Info About How To Build Personal Wealth

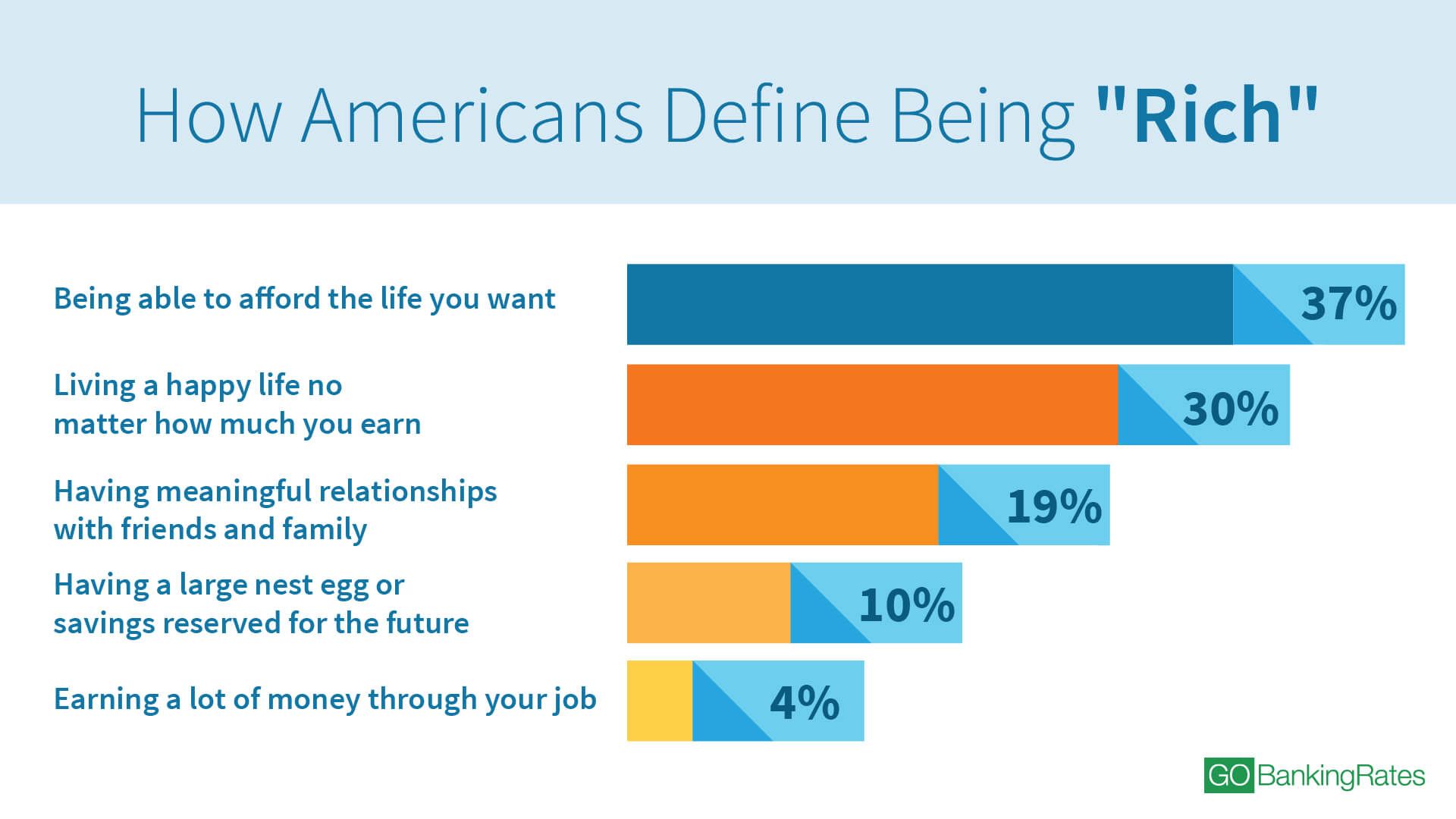

A number, in the context.

How to build personal wealth. Building wealth requires being intentional about managing your expenses — and, yes, investing. Our financial advisors offer a wealth of knowledge. 1 day agobuild wealth by investing.

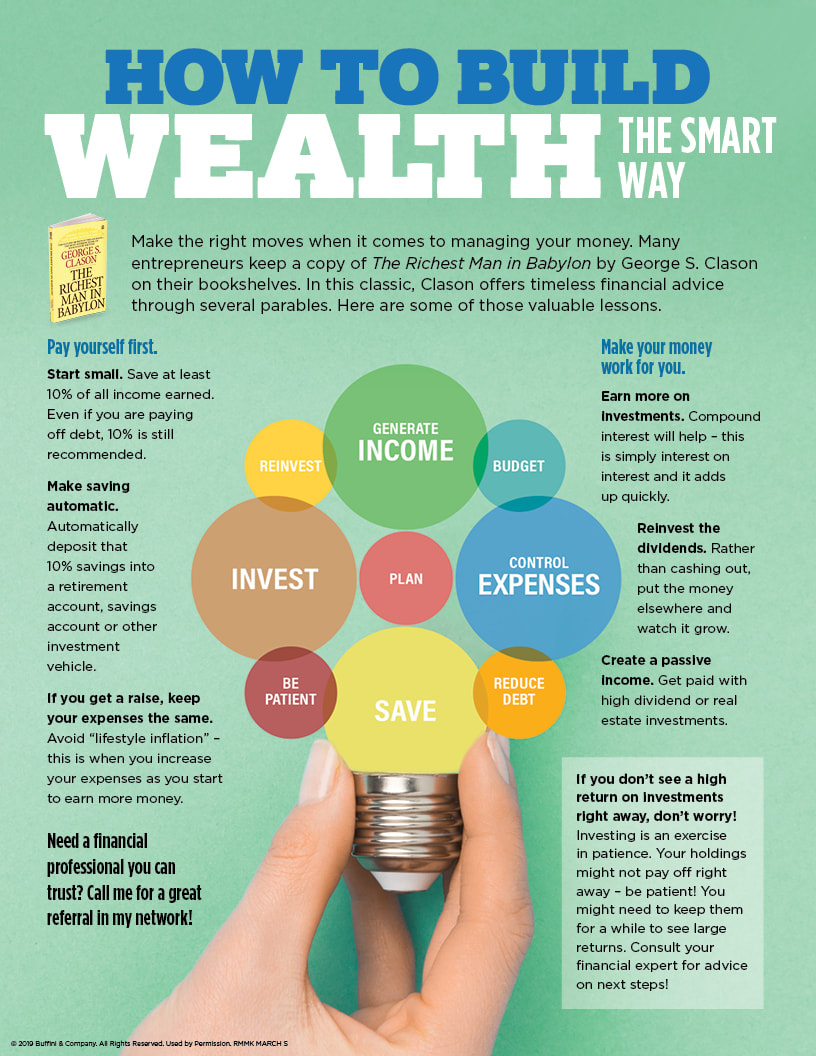

Make a budget and stick to it plenty of people dread the “b” word, but budgeting is a key plank in your wealth. Zogo is designed to be an educational platform that teaches people about personal finance in a simple and engaging way. Company loyalty will make you poor’:

I don’t want them to have to start afresh from zero. The company says it is dedicated. Where to get appreciating assets.

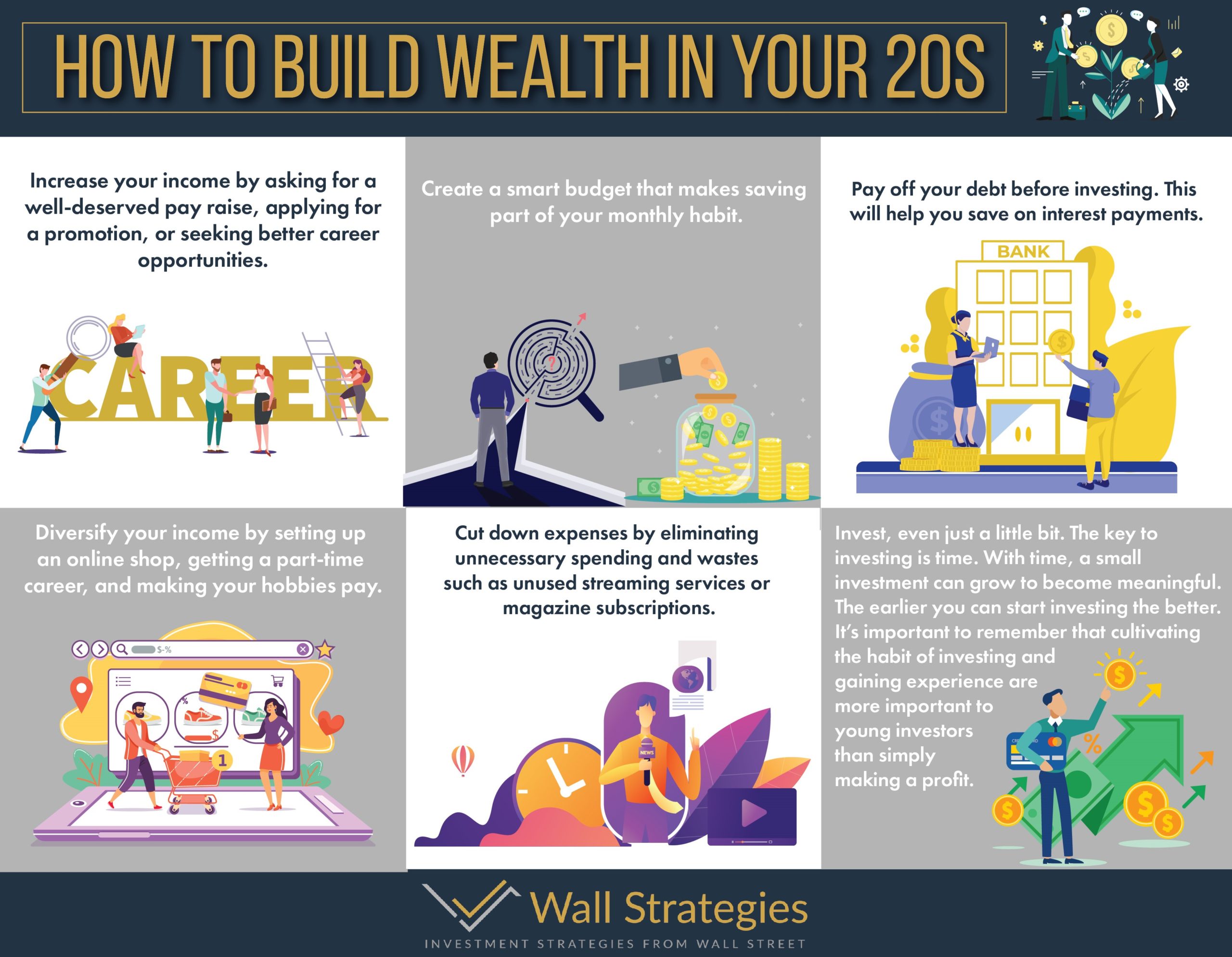

My guest on this youtube video and podcast episode is erinn bridgmann. The median net worth of a hispanic family is $36,050, according to the 2019 survey of consumer finances, the latest data available. If you want to achieve personal wealth, you have to invest in appreciating assets.

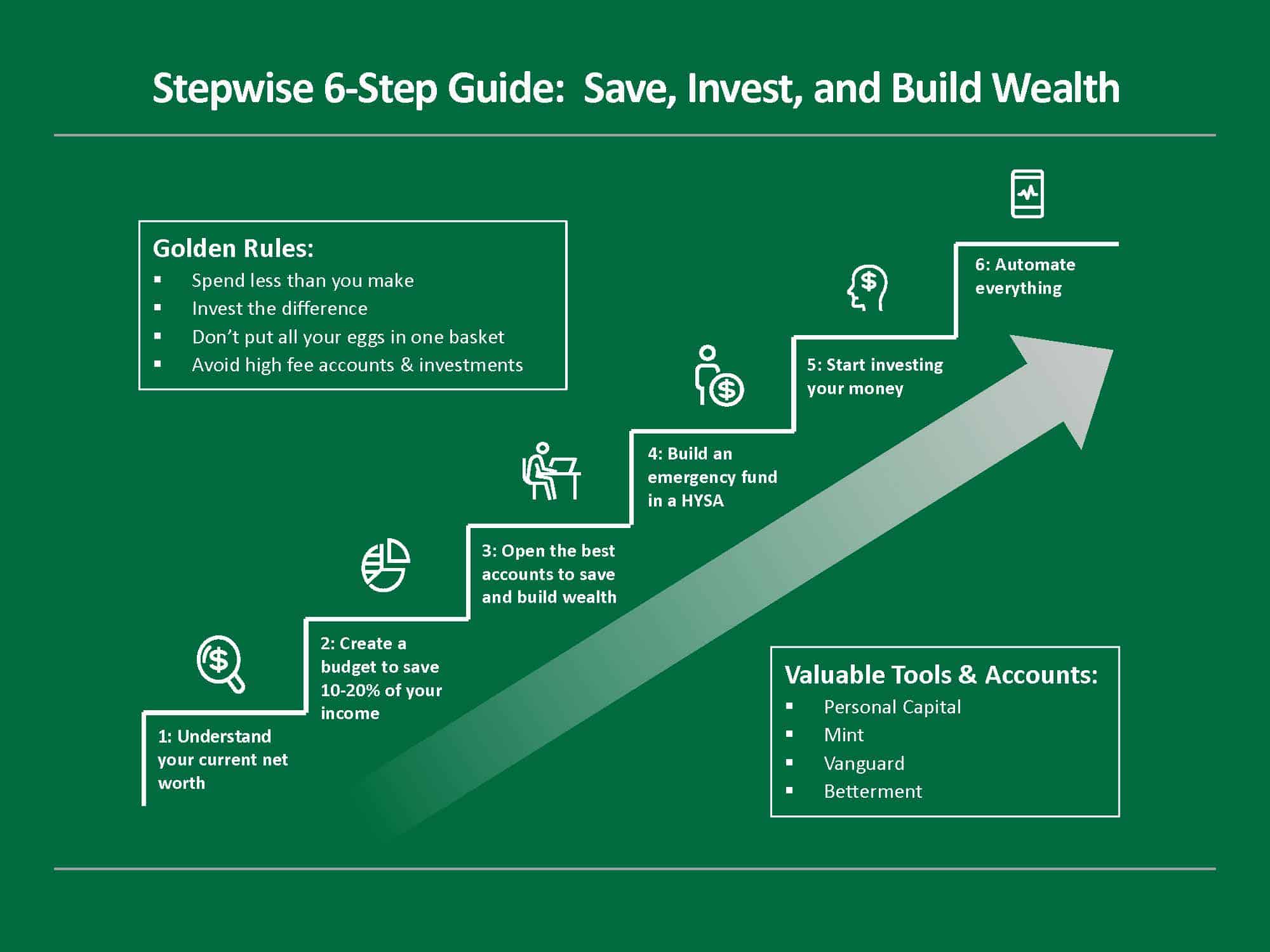

My 5 step plan to building wealth step 1: Build your emergency fund when the. Appreciating assets can be sourced from almost anywhere.

Ad discover investment options that align with your goals. These can provide tax benefits (by deferring. Once you max out those accounts, open a.

You choosing to build generational wealth is saying: You need to have a clear plan about how you will use your income (. How to build wealth 2.

A single number on its own, as far as i’m concerned, is generally meaningless. 1, the financial empowerment summit will feature free information for chicagoans on topics related to financial planning and credit building, keys to homeownership,. It allows you to build wealth through something called cash value.

In 2022, you can invest up to $20,500 in your 401 (k) plan, or $27,000 if you’re 50 or older. The reason why is because automating your finances, or sending your money automatically to investment accounts, savings accounts, and creditors allows you to build. I want those who come after me to have something good to start with.

How to build personal wealth as a coach w/ erinn bridgman. ‘own your home’ and ‘try to buy in cash’. In fact, a permanent life insurance policy is a good way for people of any age to save money.

![Wealth Building: How To Build Wealth In 30S [Wealth Formula] - Getmoneyrich](https://getmoneyrich.com/wp-content/uploads/2010/07/Wealth-Building-Image.png)