Great Tips About How To Improve The Current Ratio

For example, in 2011, current assets were $4,402 million, and current liability was.

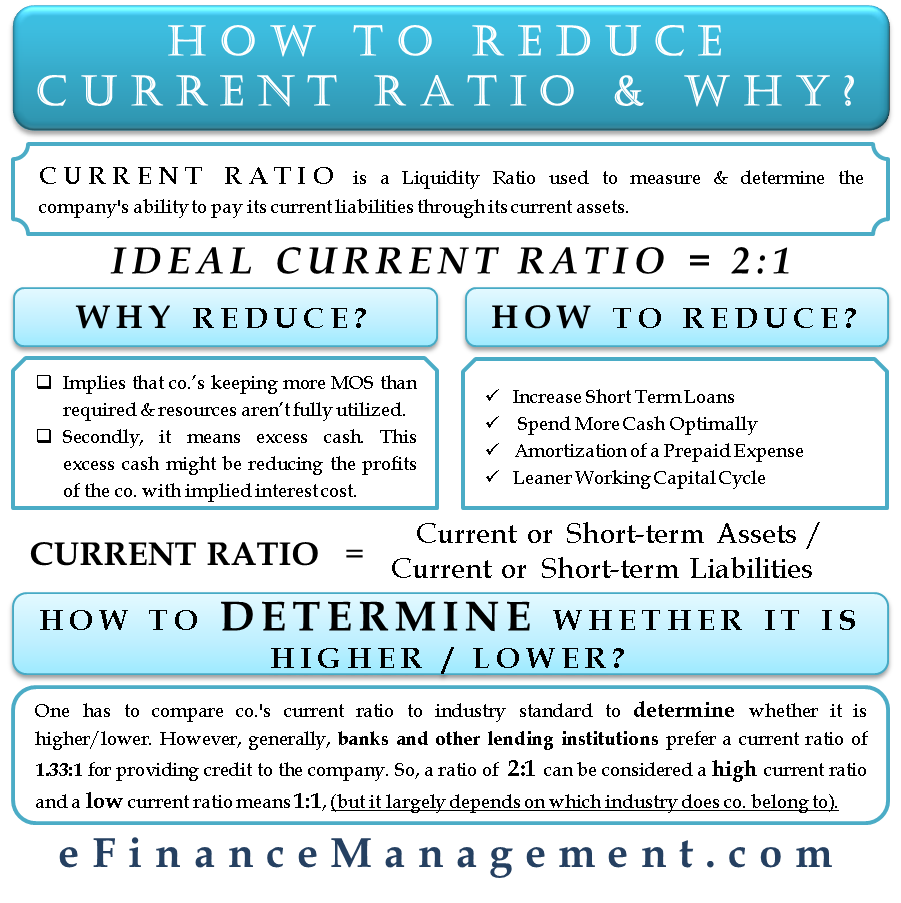

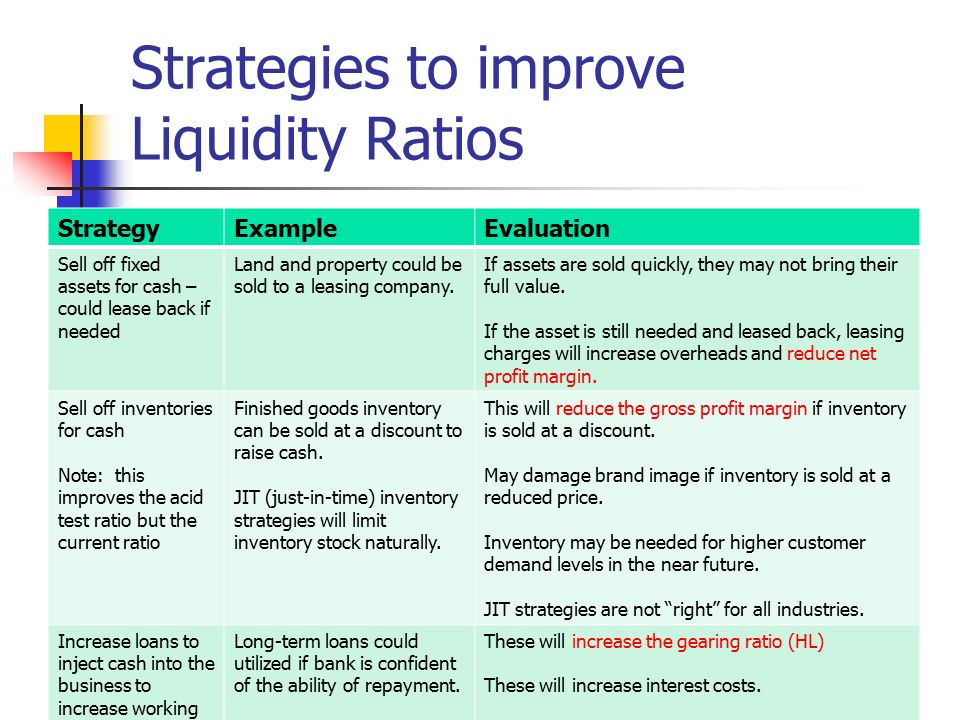

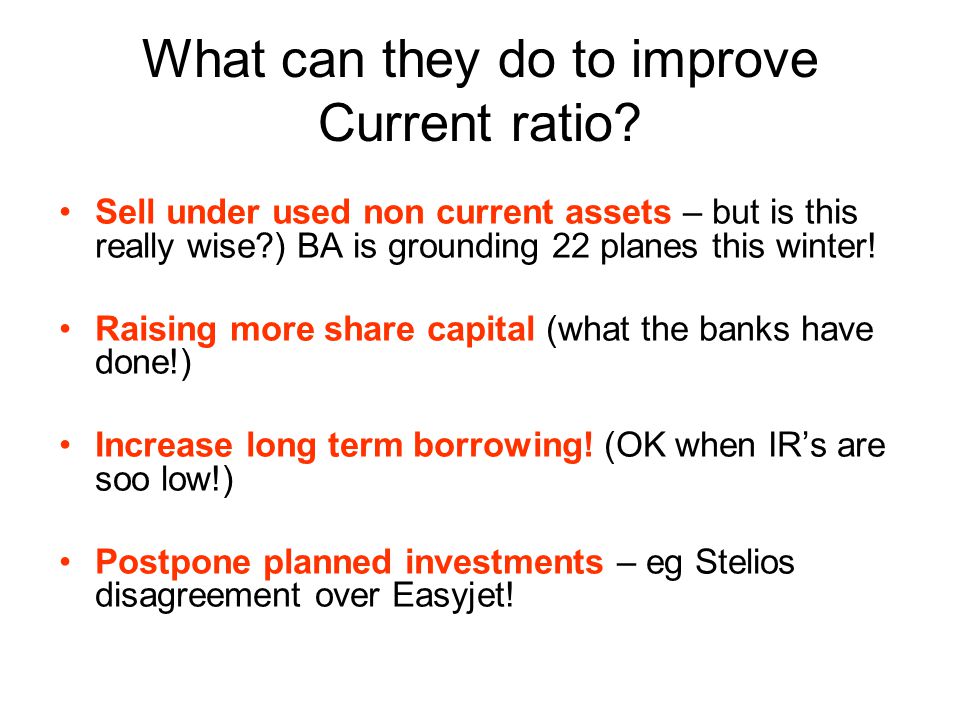

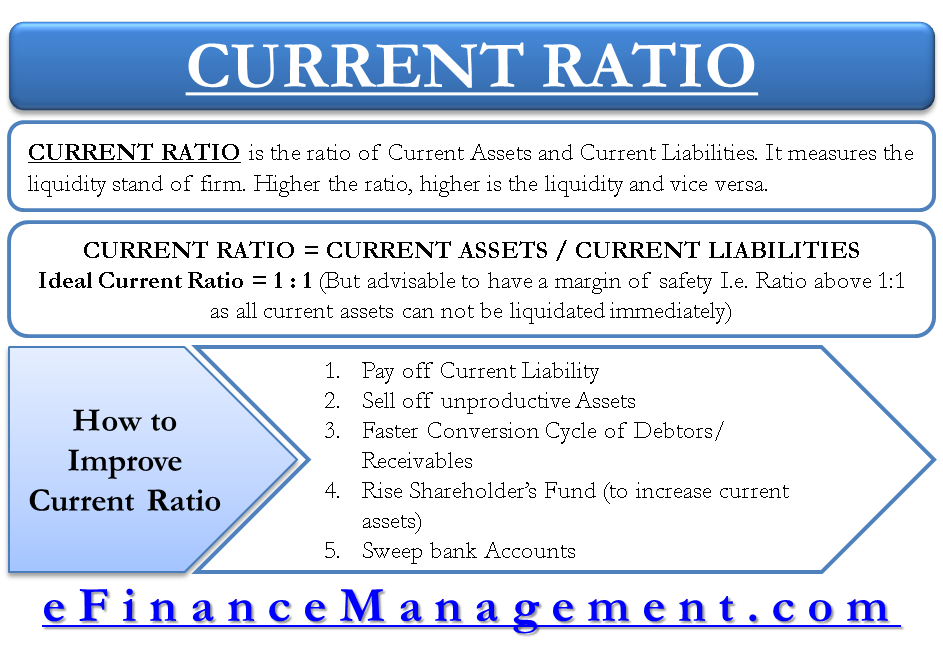

How to improve the current ratio. Improving your company’s current ratio the ideal current ratio varies by industry, but you should aim to be at or above the average in your sector. To have enough cash to pay your operating expenses, family living, taxes and all debt payments on time. Reclassifying current debts into long term debt will basically reduces.

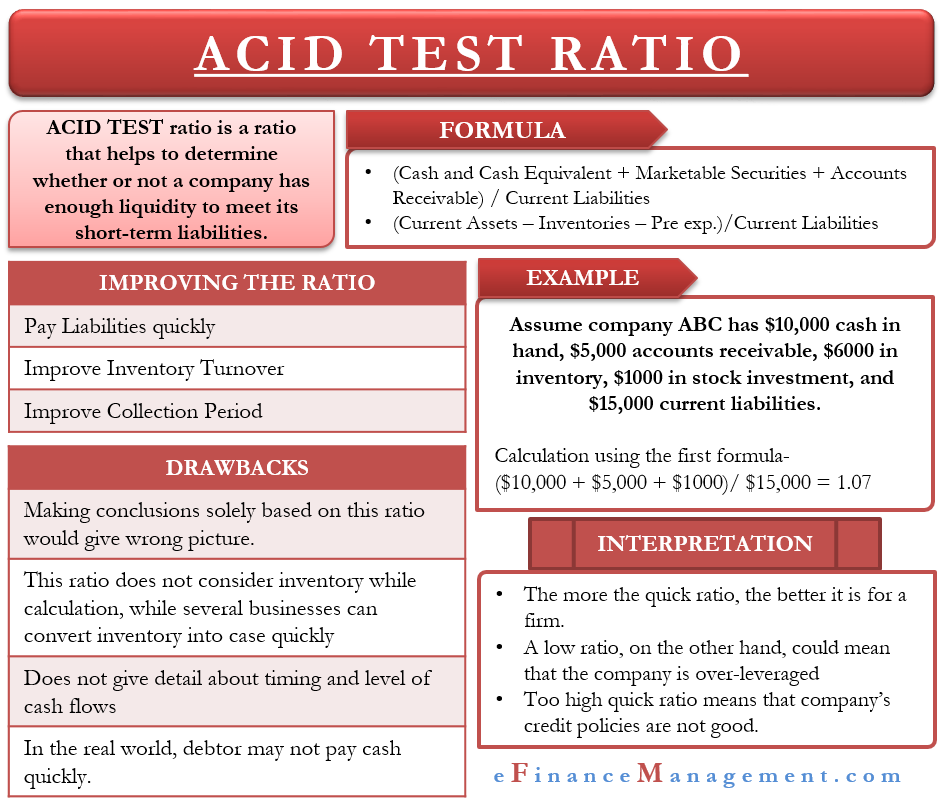

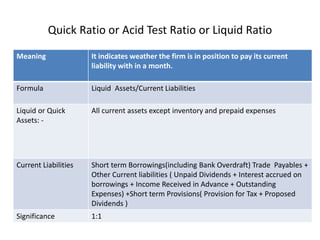

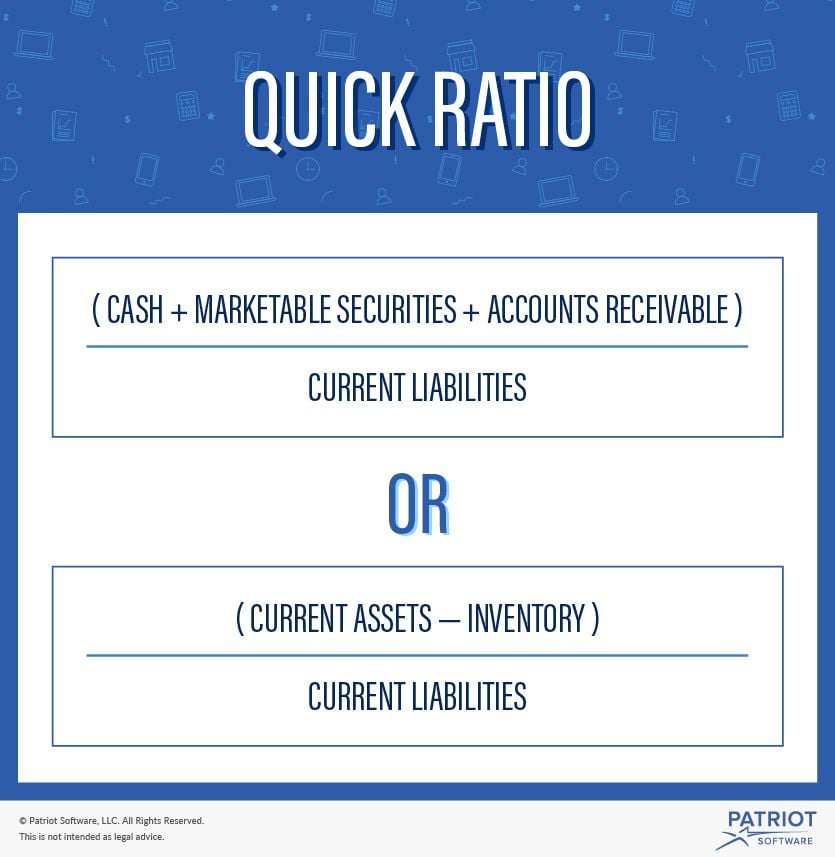

The quick ratio excludes inventory and some other current. If you want to improve the current ratio by using all your cash to pay off debt in the example, the current asset ratio would improve to. What causes increase in current ratio?

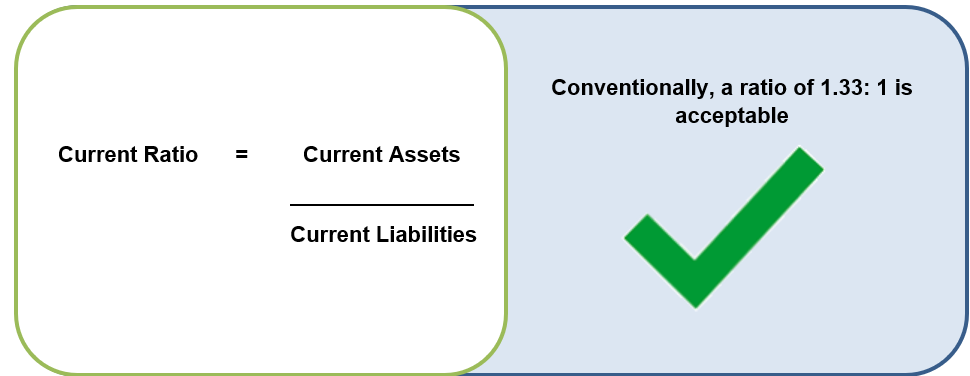

The current ratio is calculated as the current assets of colgate divided by the current liability of colgate. Improving current ratio delaying any capital purchases that would require any cash payments. First, for any beginners out there, the current ratio is current assets (anything that can be converted to cash within a year) divided by current liabilities (anything due within a year).

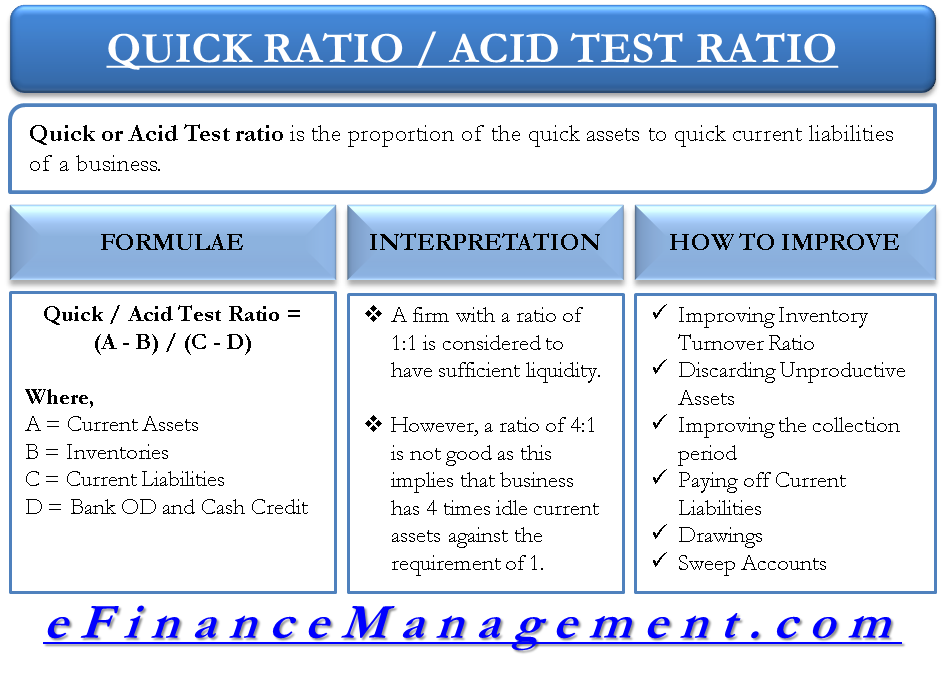

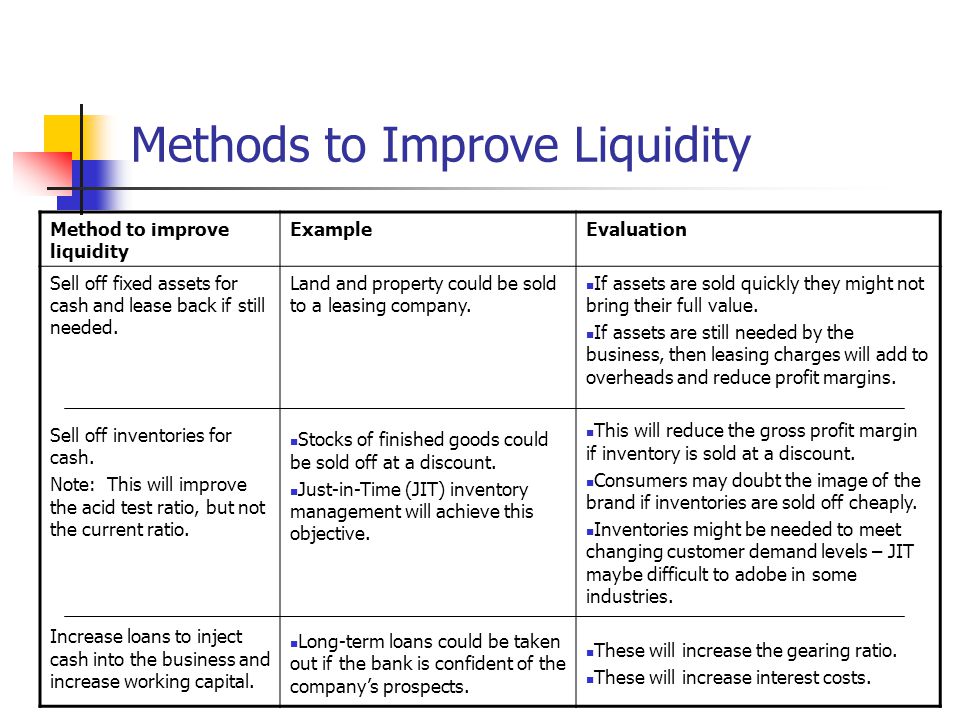

One of the quickest ways to improve the quick ratio would be to pay off the current bills and at the same time increase sales so that the cash on hand or ar increases. Two of the most common liquidity ratios are the current ratio and the quick ratio. Improving current ratio the operation can improve the current ratio and liquidity by:.

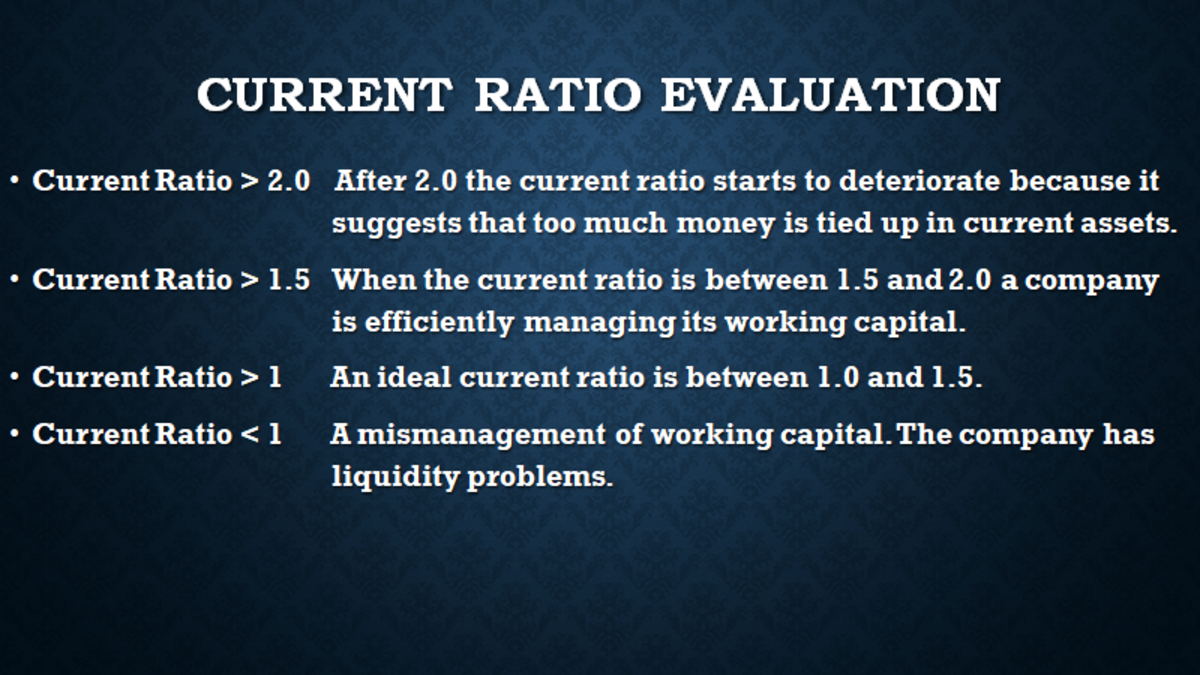

A steadily increasing current ratio would show that a company is on its way to improve its liquidity, while a declining record of current ratios could presume that the. It is calculated by dividing the company’s current assets by the company’s current liabilities. Ways in which a company can increase its liquidity ratios include.

You can improve your quick ratio by doing the following: That is, their escalations increase the total current assets. This tool refines the current ratio, measuring the amount of the most liquid assets a company has to cover liabilities.

Take the sum of the value of all of the. In this scenario, the company would have a current ratio of 1.5, calculated by dividing its current. A firm may improve its liquidity ratios by raising the value of its current assets, reducing the value of current liabilities, or negotiating delayed or lower payments to creditors.

Pay off as much debt as possible. Because the ratio is obtained through the division of current assets by the current liabilities, an increase in the. In addition to the features listed above, it can further be stated that the best manner to ensure that your company has an improved quick ratio is to ensure that there are strategies and plans.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-02-8806530bcda84b2b9cb3218413e8a417.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-03-54eeb2ed66a546ad8c2f1e5e86366170.jpg)